At Brags & Hayes we always focus on increasing the quality of service we offer clients. At the request of many customers we now accept Zelle payments. So now it is easier than ever to pay for your power generation products with Zelle® in our web store .

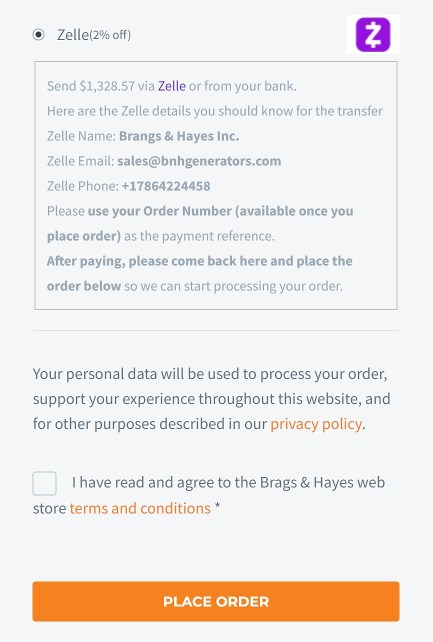

We will even give you a 2% discount on your total purchase when you pay with Zelle®!

What is zelle?

Zelle® is a great way to send money to pay for products and services, even for banking in a country other than your own. Zelle® is already enabled at many banks around the world, so look for it at your bank today.

Zelle® is an easy way to send money directly between banks (between almost any U.S. bank account) typically within minutes. With just an email address or mobile phone number, you can quickly, safely and easily send and receive money with more people, regardless of where they bank.

Generally Zelle® doesn’t charge a fee to send or receive money. We recommend confirming with your bank or credit union that there are no additional fees.

If your bank doesn’t offer Zelle® don’t worry! Their network of participating financial institutions is always growing.

For all this reasons Brags & Hayes now accepts Zelle payments… It is one more way we deliver quality service!

You can use Zelle® by downloading the Zelle® app for Android and iOS at the following links:

Zelle® app for IOs

Zelle® app for Android

Instructions for paying with Zelle® in the Brags & Hayes web store

- Find out if your banking institution is affiliated with the Zelle® network; or enroll using a Visa® or Mastercard® debit card linked to a U.S. checking account.

- If you can, register your bank account in the Zelle® network using your email and your mobile phone number through your banking institution.

- Download the Zelle® app at the links above, install it in your phone and activate it with your email and phone number.

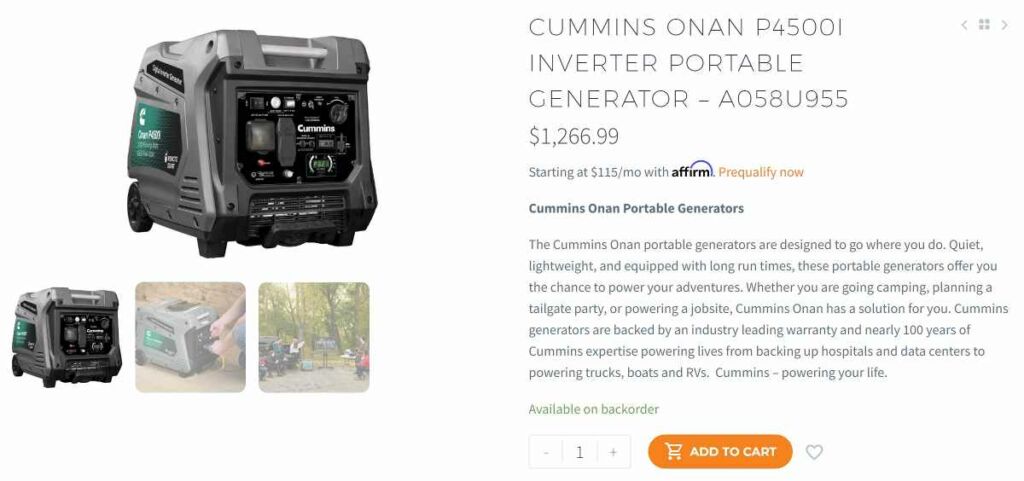

- Select the product you want to buy in the Brags & Hayes web store at the following link: Brags & Hayes web store.

- Place it in the cart by clicking the “add to cart” button.

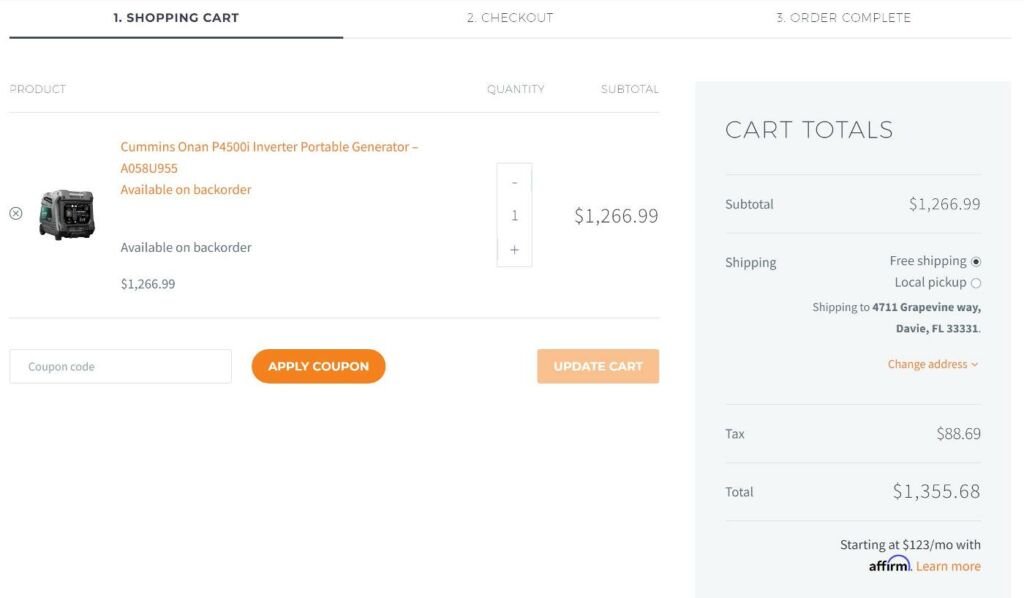

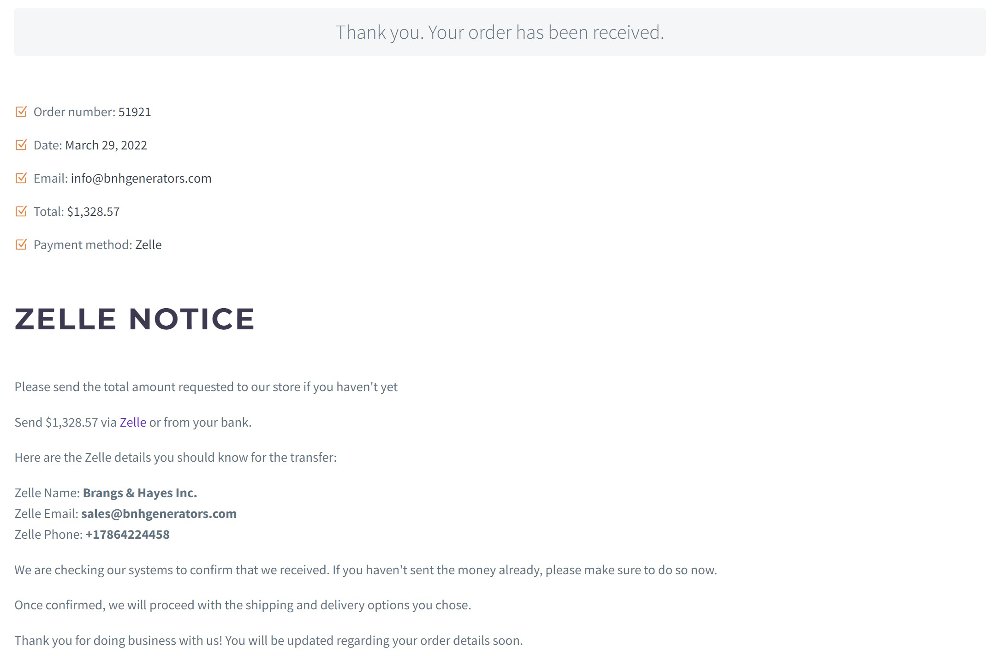

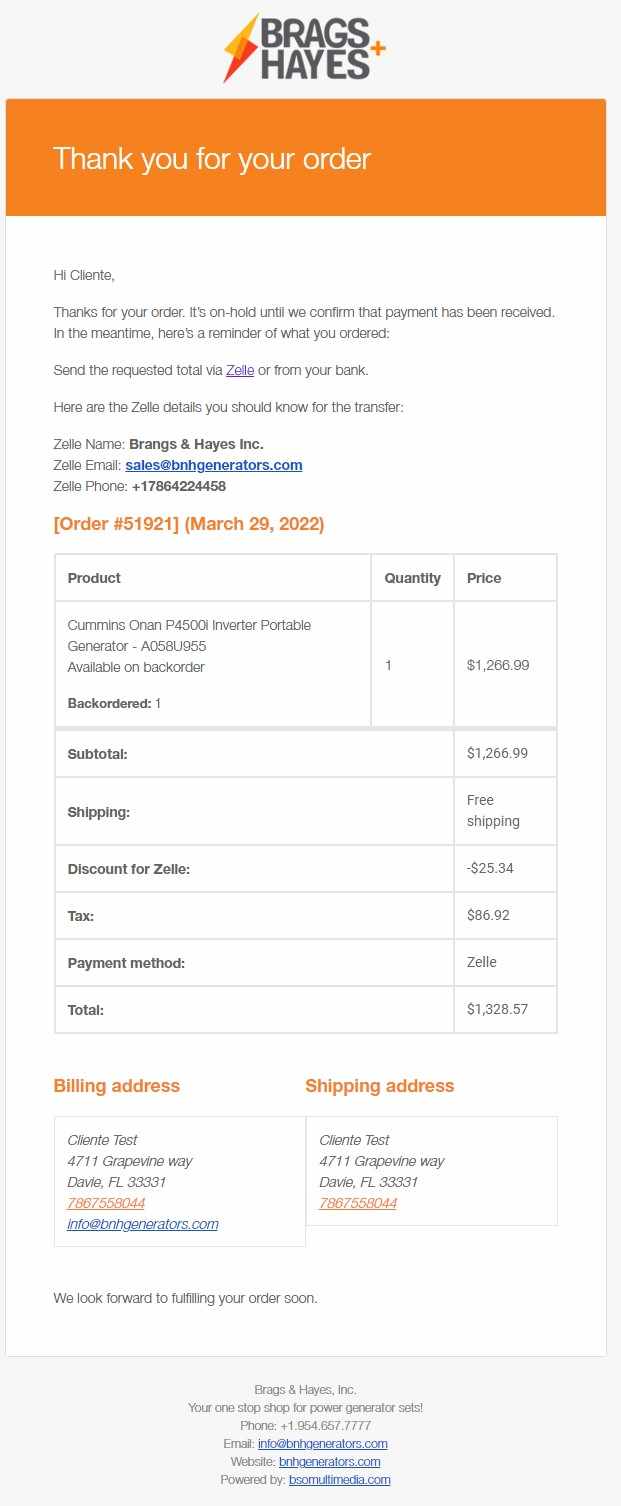

- Check your purchase carefully and when you are ready click on the check out button. Select Zelle® as your payment method and read the payment instructions carefully. Agree to the Brags & Hayes Terms of Service. Click on the “place order” button.

- Your order will be confirmed on the next screen.

- Your order will be confirmed by email notification.

- Once our sales department confirms receipt of the funds, your order will be processed.

Thank you!

We will contact you soon.

Is there a limit to how much money I can pay using Zelle?

If your bank or credit union offers Zelle®, please contact them directly to learn more about any limits they place on sending money through Zelle®.

Each bank has different limits set for payment with Zelle. At Brags & Hayes we give you the opportunity to make daily credits to your order until your payment is complete to allow you to pay with Zelle®.

Important: If your bank or credit union does not yet offer Zelle®, your weekly limit is $500. Please note that you cannot request to increase or decrease your limit.

Zelle Pay Limits at Top Banks

| Bank | Daily limits | Monthly limits |

|---|---|---|

| Ally | Up to $500/day | Up to $10,000/30 days |

| Bank of America | Up to $2,500/day | Up to $20,000/month |

| Capital One | Up to $2,000/day | Up to $10,000/month |

| Chase |

|

|

| CItibank | If you have been a Citi customer for less than 90 days:

If you have been a Citi customer for more than 90 days:

| If you have been a Citi customer for less than 90 days:

If you have been a Citi customer for more than 90 days:

|

| Citizen’s Bank | Up to $1,000/day | Up to $5,000/month |

| Discover | $600 per day | – |

| PNC Bank | Up to $1,000/day | Up to $5,000/month |

| TD Bank |

|

|

| U.S. Bank | Between $1,500 and $2,500/day | Between $5,000 and $10,000/month |

| Wells Fargo | Up to $2,500/day | Up to $4,000/month |

Note: We aim to provide the most accurate information, but the limits state above may change at any time without notice.

If your accounts appear to have different limits, we encourage you to share this information with us in the comments section below.

Easy, fast, safe and cheap.

Pay it Safe. Whether you’re using Zelle® directly through your banking app or the Zelle® app, it’s important that you know and trust everybody you send money to.